Filing a tax return can be an irritating and time-consuming task. Given that, why should anyone (especially seniors) file a return when they are not legally required to do so? There may be several good reasons. No one who does not have taxable income is legally required to file a tax return. From the tax […]

Tag Archives: taxes

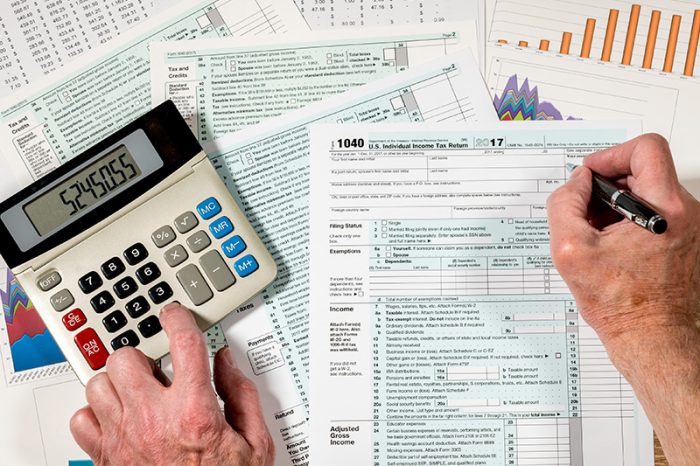

Tax season has just started, and we want to remind you to start thinking about doing your taxes now before it’s too late. While you may think you have plenty of time, April will be here before you know it. Unfortunately, taxes are not as simple as they used to be which means it takes […]

| Written by Brett Porter, EA for Winter 2020 Edition of OurSeniors.net Magazine | Every year you hear it. You may even say it yourself. “I can just write it off on my taxes,” but can you really? Most people are completely confused as to whether or not all their tax deductions are even making […]

It is not too soon to think about your tax return for 2018. Here are some important dates: Early Filing of 2018 Taxes has already begun January 28, 2019 IRS Started Processing Tax Returns (shutdown has ended) April 15, 2019 is the Tax Filing Deadline for 2019 October 15, 2019 is the Deadline for Extension […]

For some of us, it was only three months ago that we scrambled to get our tax documents to an accountant or tax preparer. “Think ahead,” may not be the advice we want to hear about 2018 taxes when the deadline for those returns is still eight months away. But wait a minute! Now is […]

- 1

- 2