Seniors Magazine

Senior living magazines typically focus on topics related to the well-being, lifestyle, and interests of seniors. They often cover a range of subjects such as health and wellness, retirement planning, travel, leisure activities, and community events. These magazines may also provide information about senior living communities, housing options, and services available for older adults.

Popular Categories

Featured Articles

SUBSCRIBED BY dONATING!

SUBSCRIBE

READ ALL ONLINE VERSIONS!

Subscription Includes:

- ONLINE ACCESS

- WEEKLY NEWSLETTER

- COUPONS AND DISCOUNTS

- MAILED COPY EVERY QUARTER

ADVERTISE

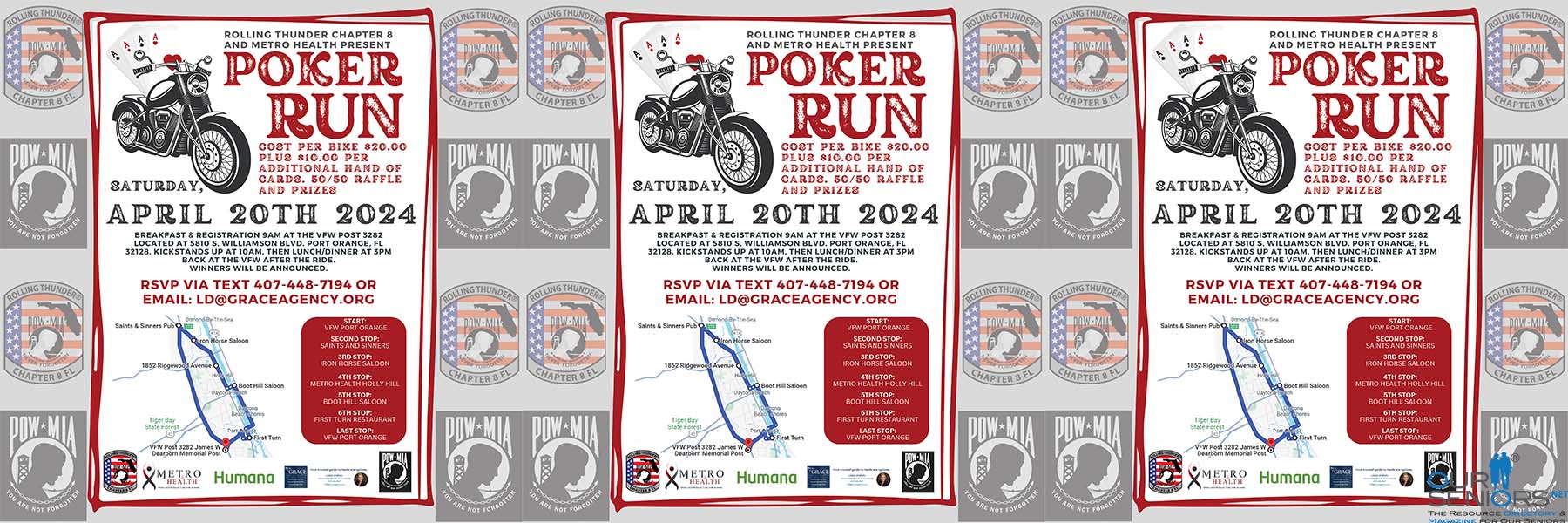

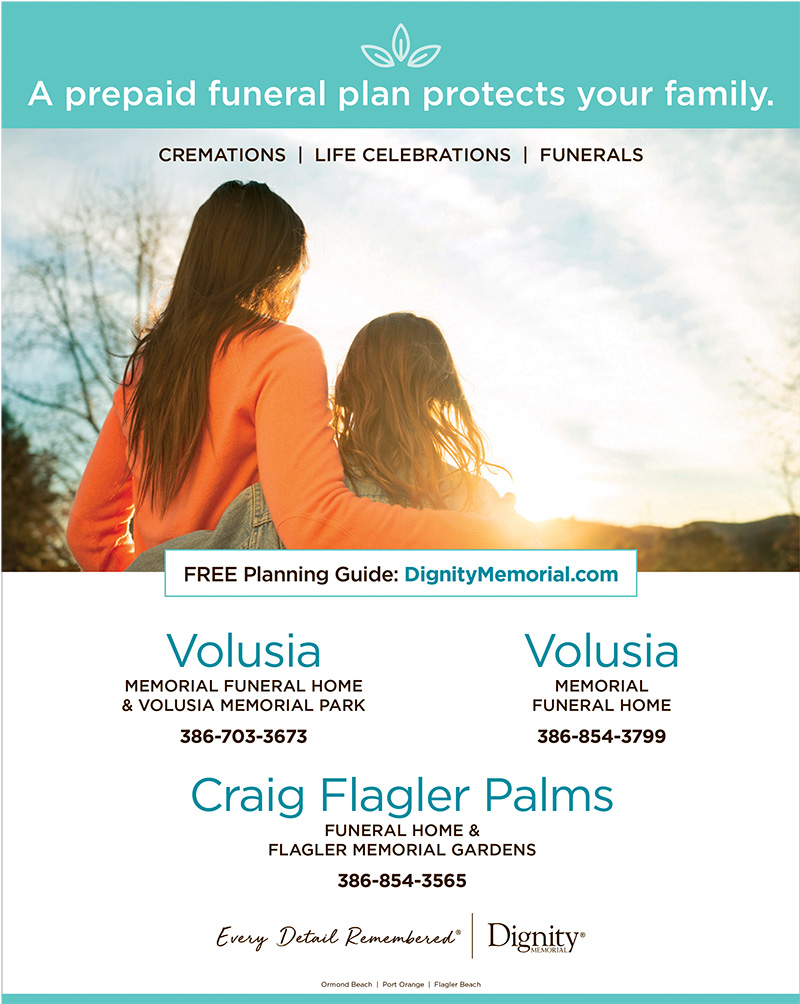

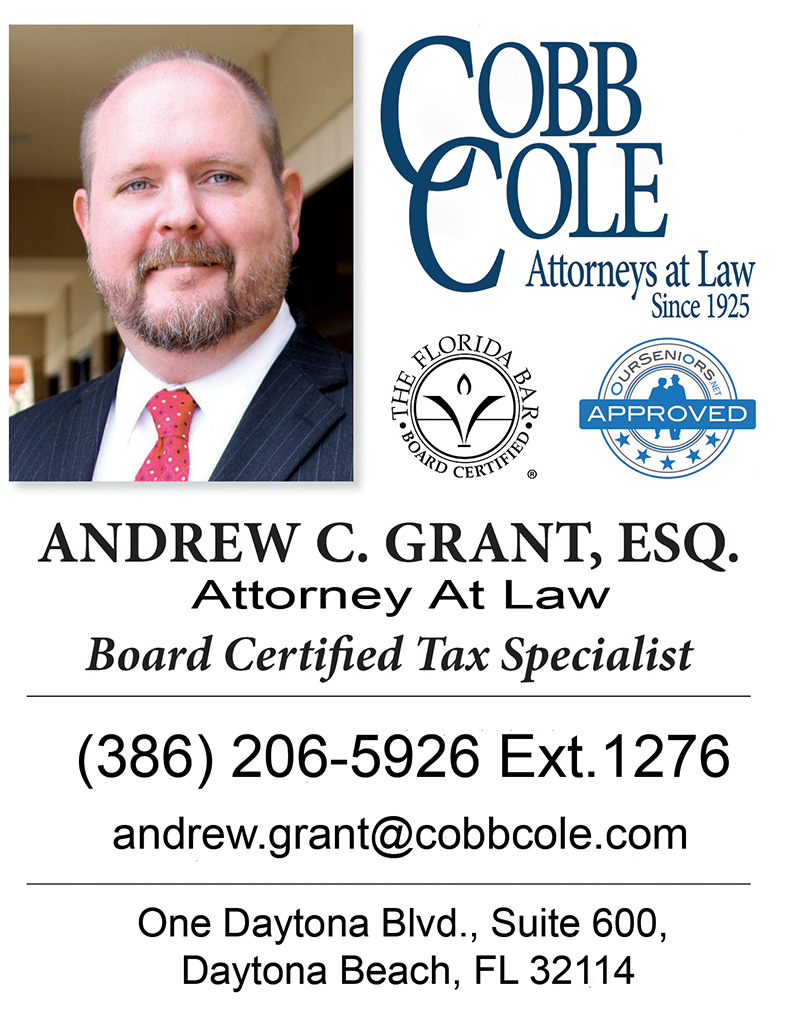

Our mission is to be a valuable source of information on trustworthy businesses and services within the various Florida communities with senior populations. We provide entertaining and informative articles on topics such as health, wellness, retirement, finance and other specific issues that impact their lives. Overall, we are dedicated to helping seniors live their best lives. Read More…

Advertise With US